OIG alleges rampant skilled nursing billing errors

Skilled nursing facility (SNF) operators greeted last week with a bombshell launched by the Office of the Inspector General (OIG). On Tuesday, the OIG published a report ominously titled “Inappropriate Payments to Skilled Nursing Facilities Cost Medicare More Than a Billion Dollars in 2009.” Unfortunately, the contents of the report were perhaps even more foreboding than the title. Indeed, the report alleges that approximately one-quarter of the claims reviewed were incorrect.

Not surprisingly, the report has been met with concern from the industry, not only questioning the OIG’s individual findings but also its extrapolation methodologies. The OIG reviewed a mere 499 claims from 245 nursing home stays and then extrapolated its findings to the over six million claims nationally for 2009. The nursing homes sampled in the report were not identified.

Using this statistical extrapolation, the OIG concluded that Medicare inappropriately paid $1.5 billion in 2009, representing 5.6 percent of the $26.9 billion paid to SNFs that year. The OIG alleged that the vast majority of the improper payments stemmed from SNFs incorrectly classifying residents within the resource utilization group (RUG) system. The OIG asserted that SNFs improperly described residents in their MDS assessments, resulting in improper RUG classifications and erroneous billings. According to the OIG, this occurred in roughly 23 percent of all claims in 2009, with upcoding—using a RUG higher than necessary—allegedly occurring in 20.3 percent of all claims.

Many of the alleged problems identified by the OIG occurred because the medical records for a beneficiary did not match the procedures for which Medicare was billed. For example, the OIG reported that 57 percent of the upcoded claims had more therapy described in the MDS than was indicated in the medical record. As well, the OIG found that 47 percent of claims had information for at least one MDS item that was not supported or consistent with medical records. An important takeaway from these statistics is the need for providers to properly keep medical records in order to support the MDS descriptions and RUG classification that lead to Medicare billings. Inconsistencies between the documents caught the attention among the OIG’s reviewers.

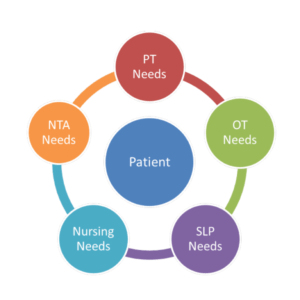

As well, the OIG’s reviewers used their own judgment to determine whether SNFs were properly treating patients. These reviewers—three registered nurses, a physical therapist, an occupational therapist and a speech therapist—compared the medical records to the Medicare billing and determined whether a procedure was reasonable and necessary. In particular, much of the focus was on the amount of therapy that was provided to patients because this is an important component of the MDS. The OIG’s reviewers found that a quarter of the upcoded claims had unreasonable or unnecessary therapy. The report provided examples of what the reviewers found to be unreasonable or unnecessary, with some examples sounding more egregious than others. For example, the OIG cited an instance in which therapy had been provided when a physician refused to sign an order for a particular therapy, but in another instance, the OIG simply found that the SNF “provided an excessive amount of therapy to the beneficiary given her condition.” In the latter instance, it very well may be that the OIG is substituting its judgment for that of the physicians and therapy professionals.

Another important subject of the report was an analysis of reporting during the look-back period. This is the period during which SNFs assess the beneficiary for purposes of the MDS, which again is connected to the RUG classification and Medicare billing rates. Again, the OIG looked at therapy provided by the SNF and found several instances in which more therapy was allegedly provided during the look-back period than during other times. Theoretically, this would serve to describe the beneficiary in its MDS as needing more therapy, and thus, the beneficiary would be classified in a higher RUG, thereby resulting in higher Medicare payments. Several examples were provided by the OIG. In one, the SNF allegedly provided 90 to 110 minutes of therapy during the look-back period and only about half of that during other times.

The OIG concluded its report with six recommendations for CMS including an increase in reviewing SNF claims, further use of the Fraud Prevention System to identify inaccurate MDS items, and changing the payment method for SNFs. CMS concurred with each recommendation in order to continue to reduce what it described as inaccurate, medically unnecessary and fraudulent claims by SNFs.

On Wednesday, the Wall Street Journal reported that the OIG is using the term “Operation Vacuum Cleaner” to refer to its review of nursing home billing issues. This term is perhaps even more foreboding than the report itself. With the fiscal cliff looming and sharp negotiations set to begin over the future of Medicare reimbursement, the timing and substance of this report are less than ideal for an industry already under fire.

Jason E. Bring, Esq., is a member of the Healthcare Group of Arnall Golden Gregory LLP. Bring defends nursing facilities in medical liability and False Claims Act cases, as well as assists them in regulatory and reimbursement issues.

Related Articles

Topics: Executive Leadership , Facility management , Medicare/Medicaid , Regulatory Compliance