Defending against Medicare contractor audits

Within the last few years LTC providers, specifically skilled nursing facilities (SNFs), have become an area of focus for audits by Medicare contractors. In fact, SNFs can expect an even higher level of attention this year than in the past. The Department of Health and Human Services (HHS) Office of Inspector General (OIG) issues an annual work plan that gives direction to the Centers for Medicare & Medicaid Services (CMS) as to where there may be problem areas which will require more audit attention in the coming year. The OIG list of potential problem areas has become known as the OIG “hit list.” This year, SNFs are on that hit list.

CMS uses Recovery Audit Contractors (RACs) to audit Medicare providers’ claims post-payment. RACs have the authority to reopen claims submitted to Medicare by providers to identify over- or underpayments. RACs may review a case to determine if the claim was billed appropriately, and if the RAC determines that billing was inappropriate, recoupment can be ordered for overpayments to the provider. RACs conduct automated reviews and complex reviews.

Automated review occurs only when there is an improper payment and it is done without review of the medical record. Examples of automated reviews include an examination of duplicate claims or pricing errors. A complex review includes an analysis of the medical record and is conducted when there is a high probability of an overpayment. RACs can request copies of medical records and other documents from providers in the course of an audit to determine the medical necessity and appropriateness of billing.

RACs are paid on a contingency fee basis, meaning that they are paid on the amount they recover. This payment structure motivates them to find improper payments. However, RACs may only audit the issues or areas of billing that CMS specifies on approved issues lists, which are updated regularly. Each RAC maintains a list of the issues approved for its review. A RAC will submit to CMS an issue it would like to review and CMS will review it and either add it to the approved issues list so the RAC may proceed with audits of that issue, or pass it on to a RAC Validation Contractor. After evaluating the issue, the RAC Validation Contractor will then issue a recommendation to CMS as to whether a full-scale review of the issue should be authorized.

RACs are paid on a contingency fee basis, meaning that they are paid on the amount they recover. This payment structure motivates them to find improper payments. However, RACs may only audit the issues or areas of billing that CMS specifies on approved issues lists, which are updated regularly. Each RAC maintains a list of the issues approved for its review. A RAC will submit to CMS an issue it would like to review and CMS will review it and either add it to the approved issues list so the RAC may proceed with audits of that issue, or pass it on to a RAC Validation Contractor. After evaluating the issue, the RAC Validation Contractor will then issue a recommendation to CMS as to whether a full-scale review of the issue should be authorized.

CMS also contracts with Zone Program Integrity Contractors (ZPICs) and Medicare Administrative Contractors (MACs). ZPICs audit cases submitted to Medicare by providers, focusing on program integrity. While RACs conduct medical review audits and focus on improper payments, ZPICs have the added responsibility of identifying suspected fraud.

MACs are another type of contractor that CMS uses to handle the processing and administration of both Part A and Part B claims. MACs’ functions include determining payment amounts, making payments, providing education, outreach and consultation services to institutions and agencies.

TARGETING THERAPY RUGs

The OIG has identified ultra high therapy Resource Utilization Groups (RUGs) as an area for CMS contractors to evaluate closely. The 2010 OIG report, “Questionable Billing by Skilled Nursing Facilities” found that ultra high therapy billing increased from 17 percent of all RUGs in 2006, to 28 percent of all RUGs in 2008. Payments for ultra high therapy RUGs increased from $5.7 billion in 2006, to $10.7 billion in 2008, a 9 percent increase. As a result of these findings, the OIG recommended that CMS increase the monitoring of SNFs. This year SNFs are on the OIG hit list.

At this point, however, ultra high therapy RUGs are not on the CMS list of approved issues, but this does not mean that RACs will not be looking at them. SNFs, with a focus on ultra high therapy RUGs, are an area of attention in the 2012 OIG Work Plan, which means RACs will likely start paying closer attention to them. A recent development for ultra high therapy RUGs is CMS’ decision to allow the RAC for Region B, CGI Solutions and Technology, to request records and audit up to 10 “test claims” to determine if CMS should focus on that type of claim. The results of a test audit could possibly lead to ultra high therapy RUGs inclusion on the RACs’ approved issues lists.

The indication from the OIG is that SNFs are frequently billing higher paying ultra high therapy RUGs when that may not necessarily be appropriate. The 2010 OIG report found that SNFs as a whole are billing for an increased number of higher paying RUGs, while the patient population has not changed. In a letter to one SNF, a RAC stated that the OIG found an “overwhelming majority of errors” in RUGs assignments by providers resulting in overpayments to SNFs. Medicare payments for therapy RUGs are nearly twice as much as for non-therapy RUGs.

THE APPEALS PROCESS

It is imperative for LTC providers to understand the Medicare appeals process in the event that they experience an unfavorable audit. The appeals process is the same for all of the Medicare contractors, except for two beginning stages which only apply to RAC audits. If the contractor is a RAC, providers may file a rebuttal within 15 calendar days of receiving the audit results. A rebuttal should include a statement as to why the recovery should not take effect on the day specified in the notice and include any other pertinent information regarding the audit. The RAC then has 15 days after receiving the rebuttal to make a determination as to whether or not the facts justify the recovery.

If the RAC determines that a recovery is justified, or the audit is performed by another contractor, a provider has 120 days to file a request for redetermination; however, the provider must file the request within 30 days to prevent recoupment of the overpayment. Following the request for redetermination, the contractor has 60 days from the date of that request to issue a decision. An adverse decision in response to a request for redetermination is not the end of the process for a provider. If a redetermination request is unsuccessful, the provider then has 180 days to file a request for reconsideration, but must file within 60 days to prevent recoupment of the overpayment. At the reconsideration level there are additional requirements that must be met, the most significant being the requirement for a full and early presentation of all the relevant evidence.

Specifically, a provider will be precluded from presenting new evidence at later stages in the appeals process, unless good cause can be demonstrated for not submitting the evidence at or before the reconsideration decision was issued. If a reconsideration request is also unsuccessful, the provider then has 60 days to file a request for a hearing with an Administrative Law Judge (ALJ).

For an appeal to reach an ALJ it must at least meet an amount in controversy requirement that can change each year. The ALJ hearing is a de novo review of the reconsideration decision. During the hearing a provider may present testimony of witnesses, including experts. For 2012, the amount in controversy requirement for ALJ hearings is $130. If a provider receives an adverse determination from an ALJ, the provider then has 60 days to file an appeal to the Medicare Appeals Council (MAC). There is no amount in controversy requirement for an appeal to progress to the MAC.

Finally, an adverse decision by the MAC can then be appealed to the federal district court if filed within 60 days. For an appeal to progress, the amount in controversy must at least be $1,350.3 The Medicare appeals process is extensive. However it is essential that providers adhere to all of the deadlines and requirements that coincide with the process.

AUDIT DEFENSE

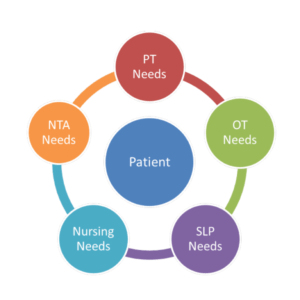

For providers involved in the appeals process, specifically SNFs, there are strategic audit defenses that may be useful to challenge an adverse determination. For instance, if an audit returned a result indicating that an ultra high therapy RUG was not correctly billed, during the appeals process the SNF could argue that the RUG billed was reasonable and medically necessary, but if the reviewer disagrees with that determination, a lower therapy level RUG should be paid instead.

Another potential audit defense for a SNF is waiver of liability. Under waiver of liability, even if the service is determined not to be reasonable and necessary, payment may be rendered if the provider or supplier did not know, and could not reasonably have been expected to know, that payment would not be made. The use of experts such as physicians or coding experts may also be helpful in appealing a contractor determination.

SUMMARY

The audit appeal process can be long and arduous. LTC providers should be especially attentive to compliance in areas that RACs and other Medicare contractors are closely monitoring. In the event of an adverse determination, it is important for providers to be diligent and comply with every requirement at every level of appeal. Involving legal counsel during the early stages of the appeals process or to review current practices for compliance with Medicare requirements may help to prevent or alleviate the harm from a Medicare audit.

Andrew B. Wachler, Esq., is the Principal of Wachler & Associates, P.C. He has been practicing healthcare law for more than 25 years. He can be reached at awachler@wachler.com. Jessica C. Lange, Esq., is an Associate at Wachler & Associates, P.C. She may be reached at jlange@wachler.com.

REFERENCES

1. Office of Inspector General. Work Plan, 2012. Available at: https://oig.hhs.gov/reports-and-publications/workplan/index.asp#current

2. Office of Inspector General. Questionable billing by skilled nursing facilities, December 2012. Available at: https://oig.hhs.gov/oei/reports/oei-02-09-00202.pdf.

3. Federal Register 2011;76(185):59138-9. Friday, September 23, 2011.

Disclaimer: This article is not legal advice. Consultation with licensed and experienced legal counsel is advised.

I Advance Senior Care is the industry-leading source for practical, in-depth, business-building, and resident care information for owners, executives, administrators, and directors of nursing at assisted living communities, skilled nursing facilities, post-acute facilities, and continuing care retirement communities. The I Advance Senior Care editorial team and industry experts provide market analysis, strategic direction, policy commentary, clinical best-practices, business management, and technology breakthroughs.

I Advance Senior Care is part of the Institute for the Advancement of Senior Care and published by Plain-English Health Care.

Related Articles

Topics: Articles , Regulatory Compliance